Thursday, April 14, 2011

Cookbook Giveaway

Tuesday, February 8, 2011

House Update

We will need about $2000 at closing to cover the closing costs of switching from a building loan to a mortgage plus the extra stuff we had done on the house that we will owe the contractor. We have $2500 right now and while that is enough, I really don't want to wipe out our savings. My husband was hoping we would get enough back from taxes to help us put more in savings, but we are only getting about $300 back, mostly due to the fact that he was on unemployment at the beginning of the year.

So, we need money saved and we need it fast. When I was looking at my budget for February, we have very little that will be left over to go in savings. We have some things that we are going to put on Ebay and Craig's list to help us get some extra money (bowflex, calipers for machining, a bin of McD and BK toys from late 90s - so if anyone is interested let me know lol).

We are also on a strict budget. I just keep telling myself we're broke. There is no extra money to spend. I was goin

g to go to a Zumba event in Elmira this weekend, but decided we need that $15 in savings, plus it would have cost us for the gas. All in all, I am better off going to Zumba at my gym because it is already paid for.

g to go to a Zumba event in Elmira this weekend, but decided we need that $15 in savings, plus it would have cost us for the gas. All in all, I am better off going to Zumba at my gym because it is already paid for.My husband's biggest issue is eating out and spending money on coffee and other crap. I know it's hard because he is going back and forth to the new house several times a week, but we have both decided to take control of this issue. So far we have eaten at home every day since last Thursday. Tonight's dinner is Chicken Paprikash (recipe from South Beach diet cookbook). Next we will work on the coffee issue. It really does all add up.

What ways do you save money or make extra money when time is running out? Let me know by leaving a comment. And for all those in the Northeast - stay warm. It's going to be cold later!! brrr. I am sooooo ready for spring already.

Saturday, November 13, 2010

Wednesday, November 3, 2010

Movies on the Cheap

joyed it. A month later, I got another $5 credit from them for some promotion they were doing, so we got some more movies. One of these movies was Avatar. It was such a great movie, I ended up actually ordering the DVD. Last weekend, hubby ended up staying home from work one night so we ended up renting one for $2.99. The movie was Pan's Labyrinth. It was AWESOME!! Even with the subtitles, my husband and I both enjoyed the movie, and thought it was worth the money. It was scary in parts (see the picture to the left), but the real terror occurred in the real life world of the little girl who was a witness to the atrocities of a revolution.

joyed it. A month later, I got another $5 credit from them for some promotion they were doing, so we got some more movies. One of these movies was Avatar. It was such a great movie, I ended up actually ordering the DVD. Last weekend, hubby ended up staying home from work one night so we ended up renting one for $2.99. The movie was Pan's Labyrinth. It was AWESOME!! Even with the subtitles, my husband and I both enjoyed the movie, and thought it was worth the money. It was scary in parts (see the picture to the left), but the real terror occurred in the real life world of the little girl who was a witness to the atrocities of a revolution.

Saturday, October 23, 2010

You can help the Food Bank provide our neighbors in need with a Thanksgiving meal this year by donating to the 1st Annual Turkey Drive sponsored by Tioga Downs Casino Racing & Entertainment. Every $10 donation enables the Food Bank to distribute two turkeys. With your generosity, more families in our community will be able to enjoy a plentiful meal on Thanksgiving Day when we raise funds through the Turkey Drive. Tioga Downs will generously match up to $20,000 in funds raised to help provide turkeys for families in need. Click here to make a secure online donation. Click here for more information or to download a Turkey Drive pledge sheet.

You can help the Food Bank provide our neighbors in need with a Thanksgiving meal this year by donating to the 1st Annual Turkey Drive sponsored by Tioga Downs Casino Racing & Entertainment. Every $10 donation enables the Food Bank to distribute two turkeys. With your generosity, more families in our community will be able to enjoy a plentiful meal on Thanksgiving Day when we raise funds through the Turkey Drive. Tioga Downs will generously match up to $20,000 in funds raised to help provide turkeys for families in need. Click here to make a secure online donation. Click here for more information or to download a Turkey Drive pledge sheet.

Friday, May 28, 2010

Budgeting Part 1

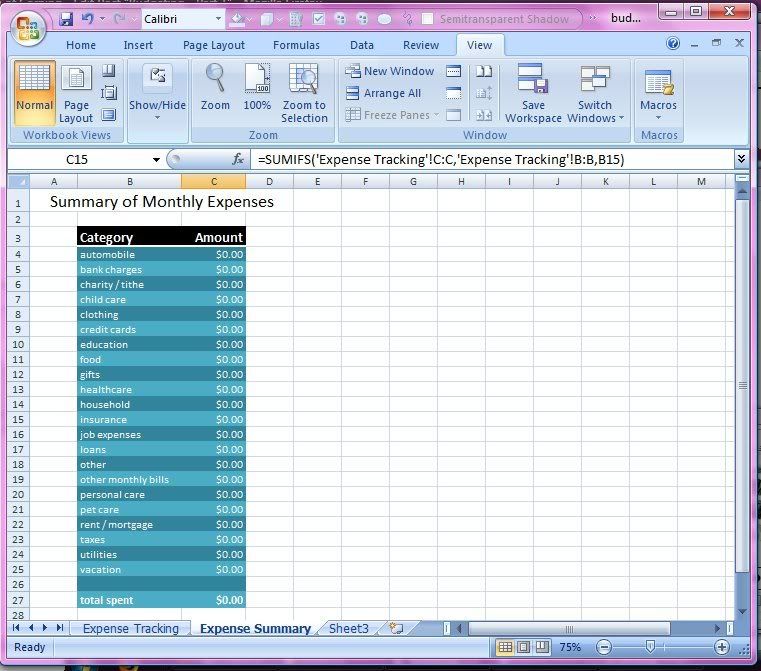

The first step to creating a budget is to track your expenses. If you have a money management program that you already use, this would be a great place to start. If you don't track your expenses, now is the time to start. Whether you do so with a computer program or a spreadsheet, or even if you use a notebook and a pencil, start now. I would suggest tracking your expenses for at least a week to see what you are spending on things like food and gas. Remember, you can always adjust your budget as needed. Your budget is not set in stone, and it should change often. I have created an Excel spreadsheet for you if you would like to download it. You can get 97-2003 or Excel 2007. (highlight file you would like to download and click on More then Download)

You will also need to list all your regular monthly bills. These are bills like rent or mortgage, insurances, car payments, utilities, credit cards, etc. To make my life easier, I take advantage of the free bill pay through my credit union. There are numerous advantages to using online bill payment. I set up my bills to be paid once a month, once a week, or they have several other payment options. I can set up one-time or recurring payments. I save money on stamps and my payments are never late, therefore no late fees. I can put in bills to be paid (for example $83 a month to NYSEG) and not have to worry about that bill again unless the amount changes. It really is a win-win situation.

You will want to either use a spreadsheet program (like Excel or Microsof

t Works Spreadsheet) or a notebook and a pencil. I prefer to use a spreadsheet because it is easier to change things easily, but you can use whichever you prefer. Now is also a good time to write down your goals. What is it you would like to accomplish financially? Do you want to pay off your credit cards or save towards a home? Put this in writing(or use Excel or Word). You can even keep your goal list on your frig to keep yourself on track.

t Works Spreadsheet) or a notebook and a pencil. I prefer to use a spreadsheet because it is easier to change things easily, but you can use whichever you prefer. Now is also a good time to write down your goals. What is it you would like to accomplish financially? Do you want to pay off your credit cards or save towards a home? Put this in writing(or use Excel or Word). You can even keep your goal list on your frig to keep yourself on track.After you have done all of these steps, you are now ready to start creating your budget. I will continue with Part 2 of Budgeting in my next post. Look for it, and please leave me any questions or comments you may have

Sunday, April 25, 2010

It's going to be a busy week!

First up on my to-do list is a meal plan. My husband will be starting his new job tomorrow after being laid off for more than a year. We're really happy that he found something, but it also means we need to start following a more strict schedule and plan everything out. The first two weeks he will be on first shift and then will be on second. What I plan to do is utilize my crock pot during the week. The night before I will cut everything up and have it all ready to go in, so that I can just throw it all in each morning. I will also need to plan lunches for the little ones since they will be going to the sitter during the day for the first two weeks (will mostly be sandwiches or mac n cheese, with a fruit and/or a veggie). I plan on giving the sitter an extra $5 to cover the milk they will drink. So, here is my meal plan for the week:

Sunday -not sure yet (leftover chicken from yesterday)

Monday - chicken n cornbread dumplings (crock pot), veggie, pudding or jello

Tuesday - leftovers

Wednesday -ham (crock pot), stuffing, veggie

Thursday - breakfast for dinner

Friday - turkey breast (crock pot)

Saturday - spaghetti, homemade bread (bread machine), green beans

Now that I've got that done, there is still plenty of things that need to get done today:

- I need to go through my coupon binder and clean it out. After my husband goes to the store and gets me a paper I will also have to cut out and add those coupons to my binder. I already looked at the sales at Tops and they're really bad, so I guess I will just get exactly what we need for the week. No stock-up shopping this week.

- For my database class I need to finish reading the chapter and take the quiz. For my C++ class I need to rework 2 lab programs and work on reading the next chapter. I also need to see how many weeks I actually have and schedule time to get all the work done.

- Laundry. Mine and the kids clothes needs to be washed and I also need to wash a load of towels. I really should do up a laundry schedule so I am not trying to do it all on Sunday.

- There is at least one more load of dishes that need to be washed. Maybe I can get hubby to work on those this afternoon. One can hope!!!

I am hoping everything goes semi-smoothly this week. If you have any suggestions on how to make the transition better, I would love to hear them.

Wednesday, February 24, 2010

Words of the Week Wednesday 11/12

It is Wednesday again and time to provide my readers with links to sites that I found interesting in the last week.

- $5 Dinner Mom. Erin Chase has one of the best blogs out there. She shows you how to feed a family of 4 dinner for $5 or less! The meals are really simple and taste wonderful. She also has a new cookbook out, so check that out while you are at her site.

- Makeusof.com. This site is more for the techy person. The reason I love it is because there are so many links to free programs, free graphics and more. It is a great site if you are interested in anything from computers to phones to graphics and more.

- Wisebread.com has a HUGE list of the top 100 personal financial blogs listed on its site. If you are interested in finding some new blogs to read check that out.

Sunday, February 21, 2010

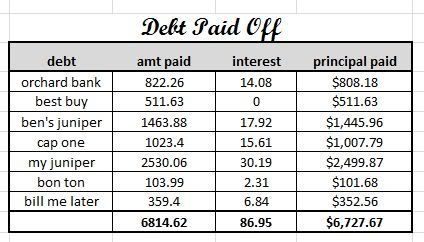

Debt Pay Off

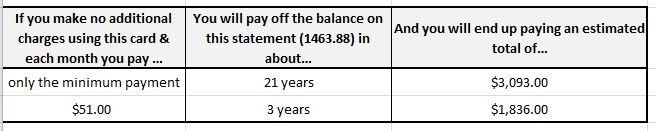

I also wanted to share with you something that I found very interesting. When my husband received his Juniper bill last month there was a chart on the first page. It showed how long it would take to pay off the bill if you only paid the minimum and if you paid $51. It only showed how much you would pay.

Saturday, February 20, 2010

Paying off Bills with Income Tax Refund

It feels really awesome to n

ot have the weight of all that debt on our shoulders anymore. We were spending about $200 on credit card debt a month (we always paid extra) and now we have that money to put in our savings each month. I was also able to add $450 to our emergency fund so now we have $1000 in there.

ot have the weight of all that debt on our shoulders anymore. We were spending about $200 on credit card debt a month (we always paid extra) and now we have that money to put in our savings each month. I was also able to add $450 to our emergency fund so now we have $1000 in there.Even if you are only getting a small amount for a tax refund, you can use this amount to reduce your debt. You can either use it for your highest interest debt or your smallest debt. Paying off your smallest debt first gives you a sense of accomplishment when it is paid off. As an added bonus, you also now have that amount to put towards the next debt to pay off. This is called snowballing.

What are you doing with your tax refund? I'd love to hear from you.